Sailing Into Prosperity: Unlocking the Potential of Offshore Trust Services for International Wide Range Preservation

The Advantages of Offshore Trust Fund Providers for Riches Preservation

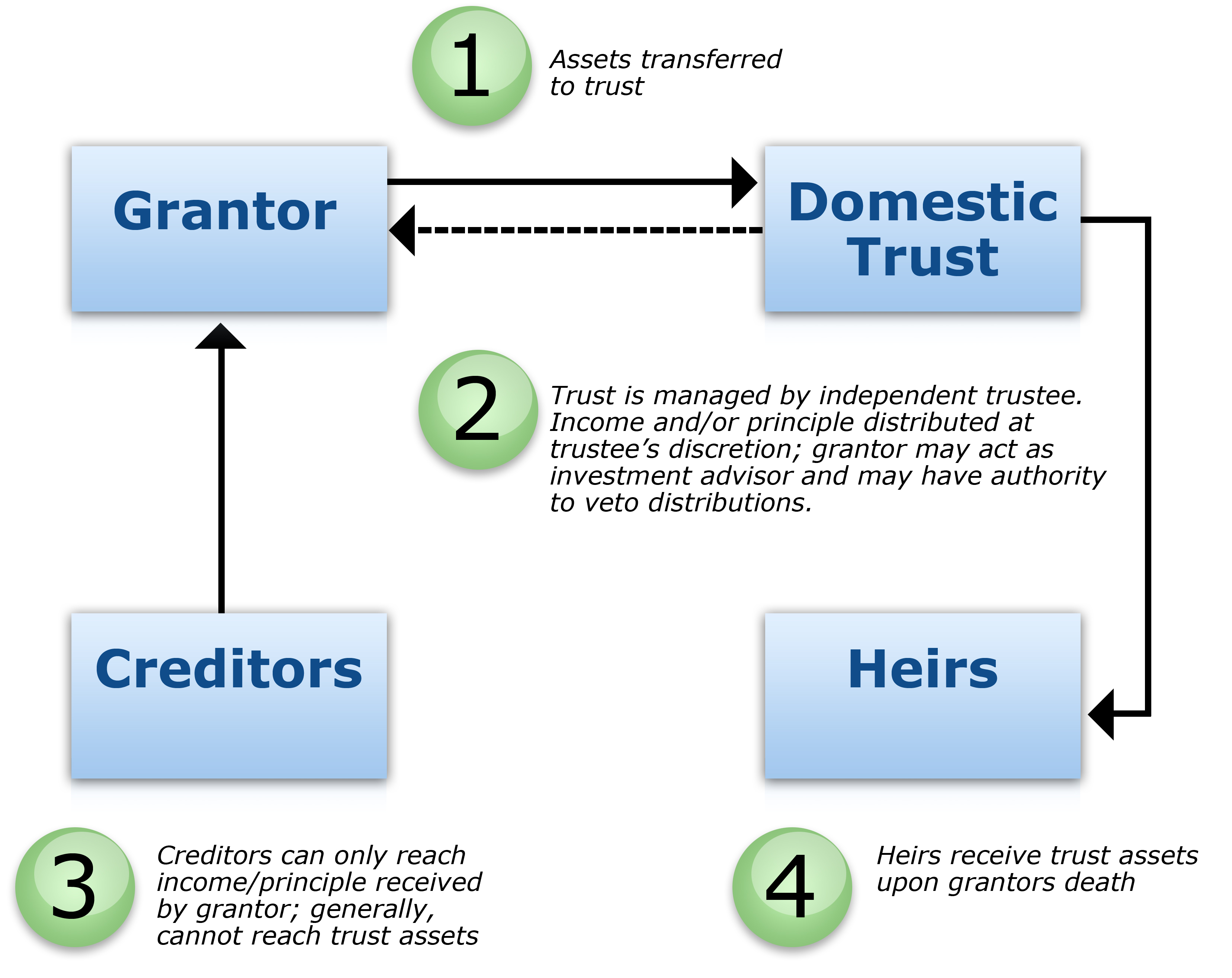

You'll be astonished at the advantages of overseas count on solutions for riches preservation. By placing your properties in an offshore count on, you produce a lawful barrier that makes it challenging for others to access your wealth.

An additional benefit of overseas trust solutions is the possibility for tax optimization. Many offshore territories supply desirable tax regulations and motivations that can assist you decrease your tax liability. By utilizing these solutions, you can lawfully reduce your tax obligation burden and maximize your wealth accumulation.

Furthermore, offshore trust fund solutions supply a higher degree of privacy and discretion. Unlike in onshore jurisdictions, where monetary details may be conveniently available, offshore counts on use a greater degree of anonymity. If you value your privacy and want to maintain your monetary affairs discreet., this can be particularly appealing.

On top of that, overseas trust services provide adaptability and control over your properties. You can pick the conditions of the trust, define exactly how it should be taken care of, and also identify when and exactly how your recipients can access the funds. This degree of control enables you to customize the depend your private requirements and objectives.

Comprehending the Lawful Framework of Offshore Depends On

Recognizing the lawful structure of overseas counts on can be complex, yet it's crucial for people looking for to preserve their wide range - offshore trustee. When it involves overseas trust funds, it is essential to understand that they are governed by certain legislations and laws, which differ from territory to jurisdiction. These legal structures determine just how the counts on are developed, managed, and strained

One secret element to consider is the option of the territory for your offshore count on. Each territory has its very own collection of legislations and regulations, and some might offer much more desirable problems for wide range conservation. You'll need to analyze aspects such as the security of the lawful system, the level of privacy given, and the tax effects before deciding.

As soon as you have actually picked a territory, it's vital to understand the lawful demands for establishing and maintaining an offshore count on. This includes abiding by reporting commitments, ensuring proper paperwork, and adhering to any constraints or limitations enforced by the territory. Failure to fulfill these demands can cause economic and lawful repercussions.

Secret Factors To Consider for Selecting an Offshore Depend On Jurisdiction

When choosing on an overseas depend on jurisdiction, it's crucial to very carefully consider aspects such as the territory's lawful stability, degree of confidentiality, and tax obligation effects. Choosing for a jurisdiction with favorable tax legislations can assist optimize the advantages of your offshore count on. By carefully taking into consideration these factors, you can choose an overseas trust territory that suits your demands and offers the essential degree of security for your riches.

Making The Most Of Asset Defense With Offshore Trust Fund Frameworks

Taking full advantage of possession defense can be attained via overseas trust you can check here structures that give why not check here a private and secure environment for protecting your wealth. By utilizing overseas counts on, you can safeguard your properties against potential legal claims and ensure their long-lasting conservation.

Offshore count on frameworks use a variety of advantages that can assist shield your assets. One crucial benefit is the capacity to establish rely on jurisdictions with strong legal structures and durable property protection laws. These jurisdictions are usually popular for their commitment to confidentiality, making it hard for creditors or litigants to gain access to information about your trust or its possessions.

Moreover, offshore depends on supply a layer of privacy. By placing your possessions in a depend on, you can maintain a specific degree of privacy, shielding them from undesirable focus or analysis. This can be especially useful for high-net-worth people or those in delicate occupations.

Along with property protection, offshore count on structures provide tax obligation advantages. visit this website Some jurisdictions enforce little to no tax on earnings generated within the trust, allowing your riches to worsen and expand gradually. This can result in considerable tax cost savings and increased wealth conservation.

General, overseas trust fund frameworks provide a safe and secure and private atmosphere for preserving your wide range. By taking full advantage of property defense with these frameworks, you can ensure the long-lasting conservation and growth of your possessions, while taking pleasure in the advantages of personal privacy and tax obligation benefits.

Checking Out Tax Benefits and Conformity Demands of Offshore Trusts

Exploring the tax obligation benefits and compliance needs of offshore depends on can supply valuable insights into the legal responsibilities and economic advantages connected with these structures. Offshore depends on are commonly located in territories that provide favorable tax regimes, such as reduced or absolutely no taxation on trust earnings and resources gains. By placing your assets in an offshore depend on, you can lawfully minimize your tax liability and optimize your wealth preservation.

Final Thought

So there you have it - the possibility of overseas count on services for global wide range preservation is enormous. By recognizing the advantages, legal framework, and essential considerations, you can make informed choices to make best use of asset protection. Additionally, discovering the tax obligation benefits and conformity requirements of overseas trusts can even more enhance your wealth preservation strategies. Don't miss out on the opportunities that offshore trust services can provide - sail into success today!

When making a decision on an overseas trust fund territory, it's crucial to thoroughly think about factors such as the territory's lawful stability, level of confidentiality, and tax obligation implications. By very carefully considering these aspects, you can pick an overseas depend on jurisdiction that matches your requirements and offers the essential degree of security for your wealth.

Offshore counts on are commonly situated in territories that provide desirable tax regimes, such as low or absolutely no taxation on trust earnings and resources gains - offshore trustee. By placing your possessions in an overseas trust fund, you can lawfully reduce your tax obligation obligation and optimize your riches preservation. Furthermore, exploring the tax obligation advantages and conformity requirements of overseas depends on can even more enhance your riches conservation strategies